Choice of asset allocation based on life stage and risk preference

Unique Auto-Switch & Auto-SWP facility takes away the hassles of adjusting the equity - debt proportion with increasing age

Load Free Switch facility

3 plans to choose – Progressive, Moderate & Conservative

| Type of Scheme | An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier). |

| Category of the Scheme | Retirement Fund |

| Plans |

|

| Lock in period | The scheme is having a compulsory lock-in of 5 years or till retirement age (whichever is earlier). Kindly note that lock in period is applicable when investor moves out of the Tata Retirement Savings Fund |

| Investment Amount |

|

| Load Structure |

Entry Load: Nil

Exit Load: |

Fund Manager

These products are suitable for investors who are seeking*:

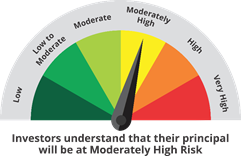

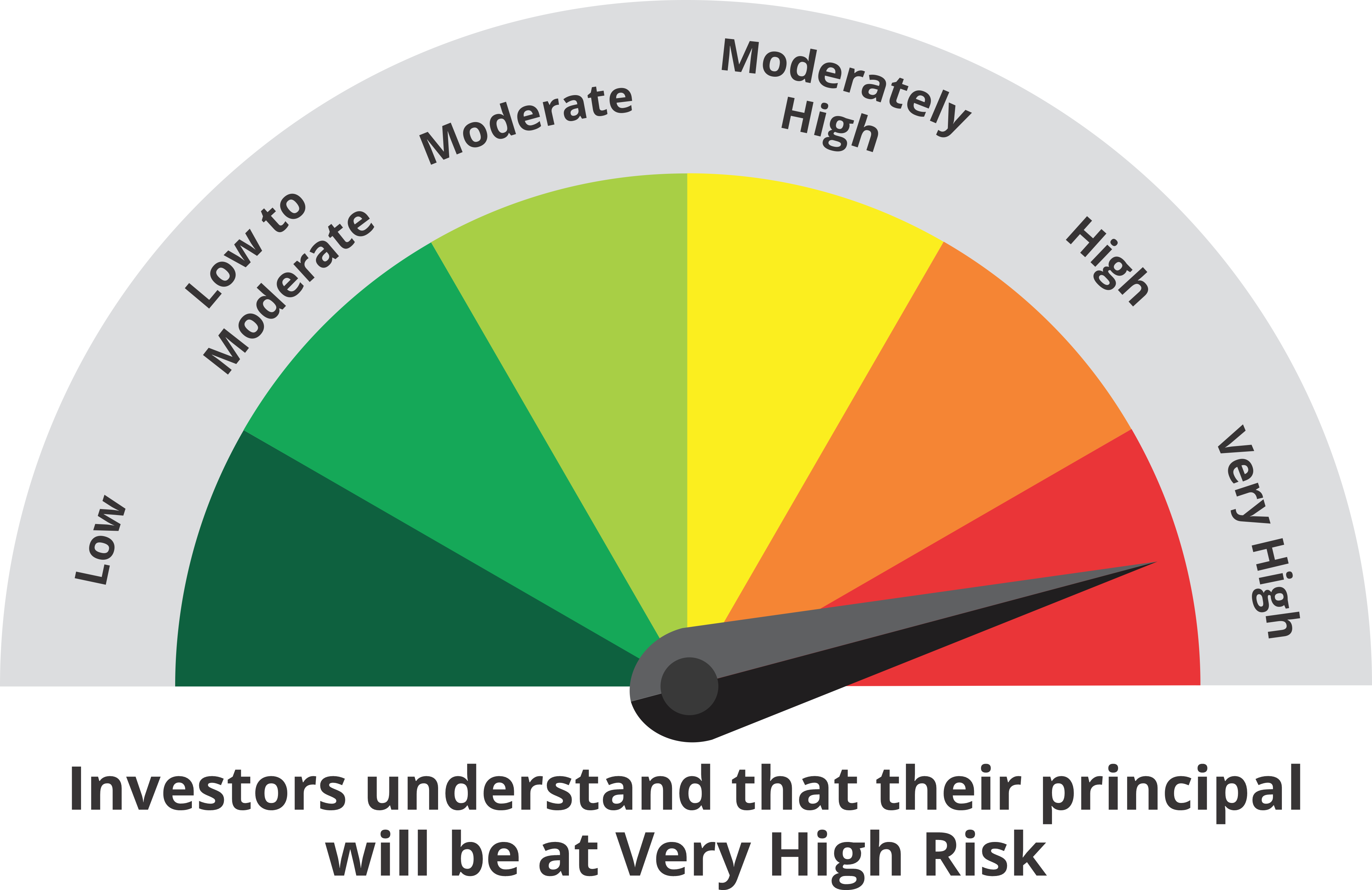

PROGRESSIVE PLAN: Long Term Capital Appreciation. An equity oriented (between 85%-100%) savings scheme which provides tool for retirement planning to individual investors.

MODERATE PLAN: Long Term Capital Appreciation & Current Income. A predominantly equity oriented (between 65%-85%) savings scheme which provides tool for retirement planning to individual investors.

CONSERVATIVE PLAN: Long Term Capital Appreciation & Current Income. A debt oriented (between 70%-100%) savings scheme which provides tool for retirement planning to individual investors.

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them